Discover the South Street Headhouse District

Where else can you have a world class dining experience, pick up a new pair of kicks, discover new music, get your palm read and then wash it all down with a 190 Octane slushy? We’ve always been a little quirky.

That’s why over 400 small businesses and independent shops chose us!

Headhouse Farmers MarketWeekly

Headhouse Shambles

S. 2nd Street and Pine Street

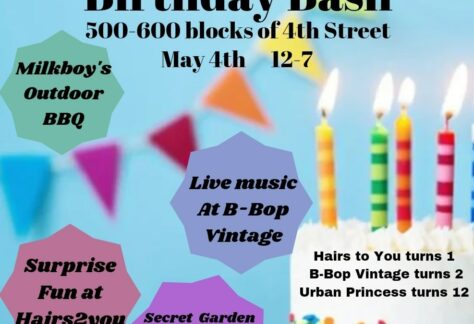

4th Street Birthday Bash!

4th & South Streets

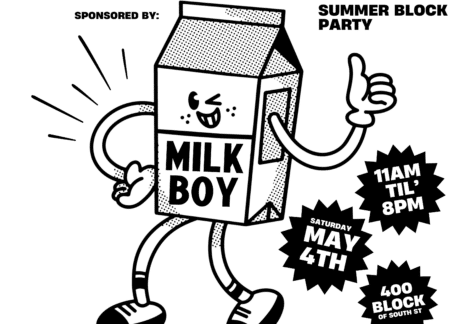

Meet Me On South Street: Summer Block Party

4th & South Streets

Headhouse Farmers MarketWeekly

Headhouse Shambles

S. 2nd Street and Pine Street

South Street Headhouse District Board Meeting

South Street Off Center

407 South St. Philadelphia, PA 19147

South Flavors Nurses Week — South Flavors

4th & South Streets

Real Estate & Zoning Committee MeetingRepeating Event

South Street Headhouse District Offices

407 South St. Philadelphia, PA 19147

BID Advisory Committee MeetingRepeating Event

Virtual Event

Marketing & Events Committee MeetingRepeating Event

Virtual Event

Vision Committee MeetingRepeating Event

Virtual Event

Centered on South

South Street in the Media

On and Around South Street:

Follow us on Instagram at @southstreetphilly to keep up with all the latest #SlightlyOffCenter news, events, and happenings.

Best of Philly 2023:

6 South Street Headhouse District Winners >

Best of Philly 2023:

6 South Street Headhouse District Winners >

Visit Philly’s Shop Philly:

South Street Headhouse District Picks >

Visit Philly’s “Shop Philly”:

South Street Headhouse District Picks >